- 易迪拓培训,专注于微波、射频、天线设计工程师的培养

基础局端 OEM 厂商必须最大限度降低 WiMAX 基站的成本才能立于不败之地并从中获利(英)

Cost counts. In telecom, that goes without saying, but it bears repeating in the case of WiMAX, which is already a highly competitive market even though the first WiMAX Forum-certified equipment is only a few months old.

For WiMAX, cost is critical because it has the potential to be both a complementary and disruptive technology. For example, some cellular operators may offer WiMAX as an adjunct service, as many do today with Wi-Fi, while telcos might use WiMAX to serve customers outside the range of their DSL infrastructure. On the disruptive side, new entrants could use WiMAX to siphon off some 3G and cable broadband customers, or to replace telco copper in cell site backhauls.

Whether those scenarios become reality hinges largely on cost. For both service providers and their customers, the appeal of a new technology depends on its ability to provide a better alternative, with “better” often measured in terms of price. Hence the importance of designs that deftly balance performance and cost, as well as operating expenditures (OPEX) and capital expenditures (CAPEX). The latter are key to a service provider’s business model and competitive position.

For infrastructure vendors, minimizing overhead costs is a matter of survival. At the end of January 2006, roughly 400 companies were developing or selling WiMAX equipment. So although WiMAX is a brand-new technology, the market is already crowded and hypercompetitive. Pricing is one yardstick that service providers will use to guide their purchasing decisions.

Infrastructure vendors are also looking to differentiate their offerings in order to make their products appear more attractive than those of their competitors. They are beginning to focus their R&D efforts on developing intellectual property in areas that improve the system performance by either increasing data rates, expanding each cell’s coverage area or improving quality of service (QoS) for end users. For example, infrastructure vendors are looking to support smart antenna technologies such as multiple input/multiple output (MIMO) and adaptive beamforming, which allow the network to support a greater number of simultaneous users and increase each site’s coverage area.

Leveraging The Past

Although WiMAX is a new technology, infrastructure OEMs can re-use designs and know-how from other areas – such as 3G and multichannel/multipoint distribution service (MMDS) fixed wireless – when expanding into 802.16d (also known as “fixed” WiMAX and 802.16-2004) or 802.16e (the “mobile” version, also known as 802.16e-2005).

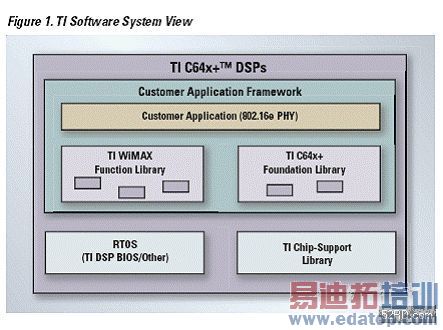

For example, Texas Instruments’ 1-GHz TMS320TCI6482 DSP, enables a high density, low-power baseband solution for 3G applications such as CDMA2000 1xEV-DO, TD-SCDMA and UMTS. The TI DSP provides the kind of signal processing functions needed in an Orthogonal Frequency Division Multiple Access (OFDMA) system, which is the basis for WiMAX. As a result, an infrastructure vendor can use the same DSP from its 3G products in order to expand into the WiMAX market. This re-use significantly reduces the vendor’s cost, risk and time-to-market, thus improving its position in the highly competitive WiMAX market.

Leveraging existing designs and know-how is particularly important for vendors that want to reduce, cost, risk and time-to-market when upgrading their system from 802.16d to 802.16e. Although the ink on the mobile WiMAX standard is barely dry – the IEEE approved 802.16e-2005 in December 2005 – WiMAX Forum-certified equipment for fixed applications has been commercially available for several months. Despite 802.16d’s head start, analyst firms such as In-Stat believe that mobile WiMAX will quickly outsell fixed equipment once it becomes commercially available, possibly by 2007.

To respond to that trend quickly and cost-effectively, infrastructure vendors should plan to use programmable components such as DSPs so that their WiMAX products can cater to both fixed and mobile applications. Indeed, some infrastructure vendors and service providers are considering skipping 802.16d and going straight to 802.16e because 802.16e infrastructure can serve both fixed and mobile users.

Base station OEMs should prepare for this trend by using WiMAX designs and components that are nimble enough to be ported across fixed and mobile applications. They also should recognize that different environments may require additional design work, such as enhanced RF front ends for 802.16e picocells for indoor coverage.

Another way to prepare for the evolution of the WiMAX standards is by designing a baseband system that can accommodate new demands. For example, TI’s product offering includes highly optimized PHY layer software libraries. Infrastructure vendors can develop their system using the software right out of the box, but at the same time, they can customize the software and add their intellectual property in order to support advanced features. This flexibility helps future-proof the base station, which is a major asset for both the vendor and its customers.

Infrastructure vendors also should choose a component supplier based on its ability to provide system analysis and reference designs – not just for individual products, but across the entire signal chain. Both can significantly reduce development costs and time-to-market. For example, Texas Instruments offers complete RF reference designs analysis to customers in order to optimize performance for both 802.16d and 802.16e.

Battle of the Bands

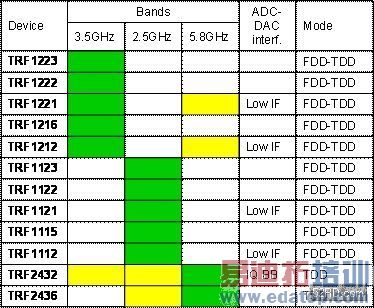

WiMAX can be used in frequency bands between 2 GHz and 11 GHz, although future versions might operate as high as 66 GHz. (The initial WiMAX products are designed for the 2.5 GHz, 3.5 GHz and 5.8 GHz bands.) The ability to operate in multiple frequency bands means that WiMAX can tap a wider market, which in turn gives it a global cost structure. That helps WiMAX compete with wired and wireless technologies – such as DSL and 3G – that also have global markets and cost structures.

The variety of bands means that vendors must design WiMAX infrastructure that can be easily and cost-effectively tuned for the country that it’s shipped to. As In-Stat noted in its January 2006 report, “The market’s biggest challenge will be worldwide harmonization of spectrum sufficient to allow manufacturers to mass-produce equipment at ever lower prices.”

The ability to accommodate country-specific frequency, power and emission requirements – and without having to do major redesigns for each market – depends upon the adaptability of the base station’s RF components. For example, TDD support can be useful because it uses each channel more efficiently than FDD, where the frequency may be left idle.

By supporting any RF interface at any available frequency, components help reduce overhead costs by minimizing the need to revamp a design for each market. For example, as Figure 2 shows, Texas Instruments offers a complete RF chipsets to support all the initial WiMAX frequency bands of interest (2.3-2.7 GHz, 3.3-3.8 GHz and 4.9-5.9 GHz with TRF12xx, 11xx and 24xx families), as well as TDD and FDD modes.

In particular, the DSP choice goes a long way toward lowering a WiMAX’s CAPEX and OPEX. For example, Texas Instruments’ TCI6482 accelerates PHY functionality such as symbol rate and FFT processing, as well as the matrix math processing needed for smart antenna applications. That improves cost per channel and power per channel. Lower power requirements significantly reduce the cost of power amplifiers, as well as the amount of electricity used to power and cool them. Those savings are a major advantage in the eyes of service providers.

What’s Inside Counts

One similarity between 3G and WiMAX is that macrocells aren’t ideal for all situations. In places such as downtown business districts or inside buildings, a microcell or picocell may be a better fit – literally. For example, real estate is always at a premium in a city’s urban core, so by using a picocell, a service provider may be able to negotiate a cheaper lease versus a full-size base station. The less money spent on leases, the greater its ability to price its WiMAX services competitively.

Picocells are an opportunity for infrastructure OEMs to differentiate themselves in the crowded WiMAX market, where full-size base stations currently abound. One way for a vendor to reduce the cost of its picocell is by utilizing TI’s flexibility and cost-competitive RF solutions, which focus on maximizing RF performance for WiMAX. This design allows customers to optimize solutions targeted to different performance levels with minimum hardware changes. For example, similar hardware platforms using TI’s TRF12xx (3.5 GHz) chipset or TRF11xx (2.5 GHz) chipset can be configured to support both CPE and BTS performance level solutions, minimizing time to market and resources necessary to provide a complete system offering.

When developing a full range of base station products – macrocells, microcells and picocells – infrastructure vendors should look for ways to re-use their baseband or channel card hardware and software for multiple applications. A single silicon platform that is capable of supporting all the above applications at multiple form factors would help the system vendors reduce their overall R&D costs.

Vendors should also look for a supplier that can provide solutions that are equally suitable for both high-end and low-end base stations. This flexibility allows the OEM to target price-sensitive markets, such as developing countries, where WiMAX is expected to be widely used as a way to bring voice and broadband to areas with little or no telecom infrastructure. Margins are thinner when selling into cost-sensitive markets, so leveraging a high-end design is one way to pursuing this opportunity and still turn a profit. It’s also a way to fend off competitors that lack the ability to compete aggressively on price.

Performance Still Matters

Although price is critical for tapping the WiMAX market, it shouldn’t come at the expense of performance. Otherwise, an infrastructure OEM will wind up stuck competing only on price, which scares off investors, or it will be passed over by service providers that are more concerned about performance – and willing to pay a premium for it.

Many infrastructure OEMs have developed WiMAX base stations that are similar to Wi-Fi in the sense that they don’t provide the enterprise- or carrier-class reliability and performance that’s required for a technology that aims to be a complement or competitor to incumbents such as 3G, DSL and cable. Although the fixed and mobile WiMAX standards both include QoS mechanisms, vendors targeting the enterprise and cellular-backhaul markets should consider offering additional QoS mechanisms, both as a market differentiator and as a way to justify a price premium

TI is cognizant of the challenges that WiMAX infrastructure vendors face today. By providing highly integrated and low-power baseband and RF solutions, TI is enabling OEMs to develop low-cost and compact base station systems. At the same time, TI’s solutions are flexible enough to be deployed in different regions to accommodate different frequency regulations, to be field upgraded to support newer features and to be used in a scalable manner to support macro, micro and pico cells. In short, TI is providing the BTS OEMs with all the necessary tools to be successful in the very competitive WiMAX marketplace.

Finally, performance is crucial simply because so much of the telecom industry’s attention is focused on WiMAX. As a result, base stations must deliver optimum performance in order to stand out from the pack and avoid the commodity trap that comes with the hypercompetitive WiMAX sector.

上一篇:分析与测量运算放大器电路中的固有噪声 – 第 2 部分:运算放大器噪声简介(英)

下一篇:LED测试与控制的自动化