- 易迪拓培训,专注于微波、射频、天线设计工程师的培养

英特尔又有啥大麻烦了

随着营收和运营收入的增长放缓,英特尔数据中心业务正面临新的威胁;2015年数据中心业务平台的销售价格上涨十分有限;如果企业购买继续爆冷,英特尔可能希望更深的切入ASP市场,而这一领域,博通和高通将是其最大威胁;考虑到芯片供应商的庞大数量,用户可能更愿意采用基于ARM的系统。

Summary

New threats to the Intel Data Center Group emerge as its revenues and operating income growth decelerate. The average selling prices on the Data Center Group platform have increased only minimally in 2015. Intel may want to cut the ASP deeper if enterprise buying remains cool and new competitors, Qualcomm and Broadcom, become threats. Customers may be more willing to adopt ARM-based systems from big cap chip makers.Shares of Intel (NASDAQ:INTC) sold off in early January. Investors were reluctant to step back in after Gartner said the global outlook for PC shipments in 2016 is for a decline of 1% compared with 2015, with the potential for a soft recovery in late 2016. The PC market is still in the middle of structural change, which will reduce the PC installed base in the next few years, according to the Gartner report.

Notebook sales aren't doing so great either, according to Chris Danely of Citigroup, who downgraded the chip sector in February, citing that Taiwan notebook ODM shipments declined 38% month-over-month in January, below the three-year average of being down 14% on a month-to-month basis.

The good news for Intel might be that spending for data center systems is projected to grow 3% year-on-year, and the demand in this segment is expected to continue to be strong through 2016, according to Gartner. Intel's investors are hoping for a revenue rebound in its lucrative Data Center Group, DCG, which makes microprocessors, chipsets and SoC that are used in servers, storage and switches to power data centers. In the fourth-quarter 2015, the company said DCG revenue grew just 5.3% year-on-year, compared to a 25.4% clip during the same quarter in 2014. Most analysts had expected previous double-digit percentage gains to continue.

Revenues and operating income growth from the Data Center Group, which accounted for 28.86% and 15.53% of total revenue and operating income in 2015, are decelerating. From Intel's earnings statements, the DCG revenue grew 11.05% in 2015, compared to 18.3% in 2014, while the operating income grew only 6.14% in 2015, compared to the explosive growth of 30.17% in 2014.

Notably, the average selling prices, ASPs, on the DCG platform increased just 3% in 2015, compared to a 10% increase in 2014, while the unit volume growth was 8% in 2015, as it was in 2014. In fact, the ASP during the fourth-quarter 2015 was down 1% compared to the third-quarter 2015, and to the same quarter in 2014. Intel may want to cut the ASP deeper if enterprise buying remains cool and new competitors begin to emerge, as they try to maintain the high single digit growth.

Data Center Chip Race Gets Crowded

Early in January, Annapurna Labs, Ltd., an Israeli chip designer that Amazon (NASDAQ:AMZN) bought for between $350 and $375 million last year, sent out a press release saying it will start rolling out a new line of ARM-based chips called Alpine, which can run WiFi routers, power connected devices, and handle networking and storage functions for data centers. The chips will be sold to makers of products for homes and data centers.

Here is what Intel Senior Vice President General Manager, Data Center Group, Diane Bryant told Business Insider:

When you have 97% share of the market, you're always looking for where the competition may come in, … As long as I can give the cloud service providers the best technology, I believe [customers] will continue to rely on us based on the investment that we make.".

Qualcomm (NASDAQ:QCOM) announced in mid-January that it had entered into an agreement with the Chinese province of Guizhou to create a joint venture called Guizhou Huaxintong Semi-Conductor Technology Co. Qualcomm plans to enter the server CPU market that Intel dominates, with a customer processor chip built using the ARM architecture, which is less expensive and may also consume less power.

Intel immediately fired back several days later with an announcement of a new joint venture to design chips through a research partnership with Tsinghua University and Montage Technology Global Holdings. Intel will put $100 million into the venture.

Advanced Micro Devices (NASDAQ:AMD) announced in January that they had started volume shipments of its "Seattle" Opteron A1100 ARM processors, designed for high-density server systems. The Opteron A1100 chips will power web servers, networking appliances and storage arrays. So far, analyst views on the new AMD 64-bit ARM chip have been mixed.

Chip companies, including Broadcom (NASDAQ:AVGO), Applied Micro (NASDAQ:AMCC) and Cavium (NASDAQ:CAVM), could soon try to take a bite from Intel's near-monopoly market share with their Vulcan 64-bit ARM server processor, X-Gene family of ARM server chips and ThunderX ARM processor, respectively.

In our opinion, a real threat to Intel's data center market may be still years away since large scale data centers still mainly run on x86 chips. A change in an infrastructure from x86 to ARM will be quite an undertaking due to enormous investment in hardware and software.

Overviews of Intel and Its Competitors

Intel - The acquisition of Altera by Intel was completed in early fiscal year 2016 and Altera has emerged as a stand alone unit called the Programmable Solutions Group. Intel once said that the company had a plan to create a hybrid Xeon-FPGA chip that will plug into a single processor socket. As competition in the data center business is heating up, it is highly critical for Intel to convince Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Facebook (NASDAQ:FB) and others to switch from the graphics processor unit, GPU, chips to the Intel hybrid Xeon-FPGA chip to power their artificial intelligence tools, including speech recognition, image recognition, and natural language processing.

Intel Tehnical Chart

Technically, INTC was under selling pressure earlier this year, but is on the rebound, as analysts had raised concerns over PC and notebook sales during the first-quarter 2016. Rumors that Google would start designing their own chips will not support Intel shares much either. The stock is trading in a symmetrical triangle chart pattern, as well as under the major moving averages, meaning the stock could pull back to the retest the lower trendline support of the symmetrical triangle at around $28 a share. If the stock breaks out, the projected price would be $34 a share. As of March 1, Intel is the largest holding in the Market Vectors Semiconductor ETF (NYSEARCA:SMH), with a weight of 17.93%.

Qualcomm - Qualcomm recently released its fiscal 2016 first-quarter earnings report, which came in well above expectations, but a license dispute with LG surfaced and fiscal 2016 second-quarter guidance disappointed due to the impact of a challenging macro environment. Qualcomm confirmed that their flagship Snapdragon 820 would power the latest LG G5, one day ahead of the Mobile World Congress in Barcelona.

A Bloomberg report in early February that Google was poised to endorse Qualcomm's server chip efforts turned out to be a rumor. Hence, we expect that Intel will step up with their data center server chip innovations and pricing, which will put more pressure on Qualcomm shares. Qualcomm has a weight of 8.16% in the SMH ETF.

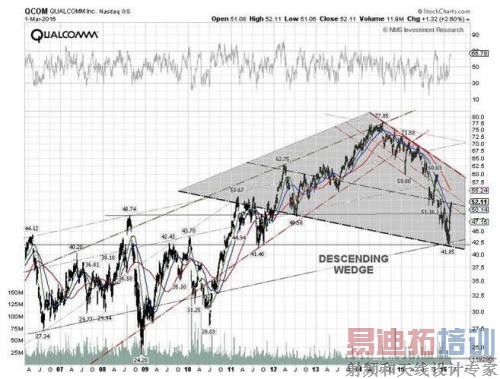

Qualcomm Techncial Chart

Shares of Qualcomm have performed poorly during the past 10 years. QCOM bounced off a four-year low at $41.85 a share in mid-February and the stock is now trading near the $51 a share trendline resistance level. The stock can make a breakout if it can close and stay above $58 a share, but there are walls of resistances between now and the $58 a share level. There is support at $49 a share level if the stock pulls back.

Broadcom Ltd - The acquisition of Broadcom by Avago was completed in early February 2016 and the new company emerged as Broadcom Limited. After the merger, the company became one of largest analog and mixed-signal chip makers for automotive, industrial, and communications, as well as custom network chips. Broadcom is a major supplier for Apple (NASDAQ:AAPL) with revenue exposure of between 10% and 15%. Broadcom Ltd earnings reports are due March 3. Most analysts are bullish on the stock.

Broadcom Ltd Technical Chart

Technically, AVGO is trading at the top of the range and is about to break out the symmetrical triangle chart pattern. In a breakout event, the stock could retest the $149 level before making a new high. There are several supports if the stock pulls back. Broadcom has a weight of 5.15% in the SMH ETF.

Conclusions - Shares of Intel sold off earlier this year after reports said that the global outlook for PC shipments and notebook sales in 2016 were on a decline. The good news for Intel is that spending for data center systems is projected to grow and demand is expected to continue to be strong through 2016. But, there are concerns of new threats to the Intel Data Center Group as its revenues and operating income growth decelerate. The average selling prices, ASPs, on the Data Center Group platform have increased only minimally in 2015, and Intel may want to cut the ASP deeper if enterprise buying remains cool and new competitors, such as Qualcomm, Broadcom, Advanced Micro, and others, begin to emerge.

In our opinion, the big cap competitors represent a near-term threat to Intel's data center business as customers become more willing to try new ARM-based ecosystems if large capital resources are behind research and development, software development and support that may improve over time.